Market economies are fundamentally characterized by economic cycles. They are made up of expansionary times and contractive times, or expansions and recessions, respectively. Comprehending these cycles and their underlying dynamics is essential for making wise financial choices.

What is a Recession?

A recession is a significant decline in economic activity that lasts more than a few months. It’s visible in industrial production, employment, real income, and wholesale-retail trade. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

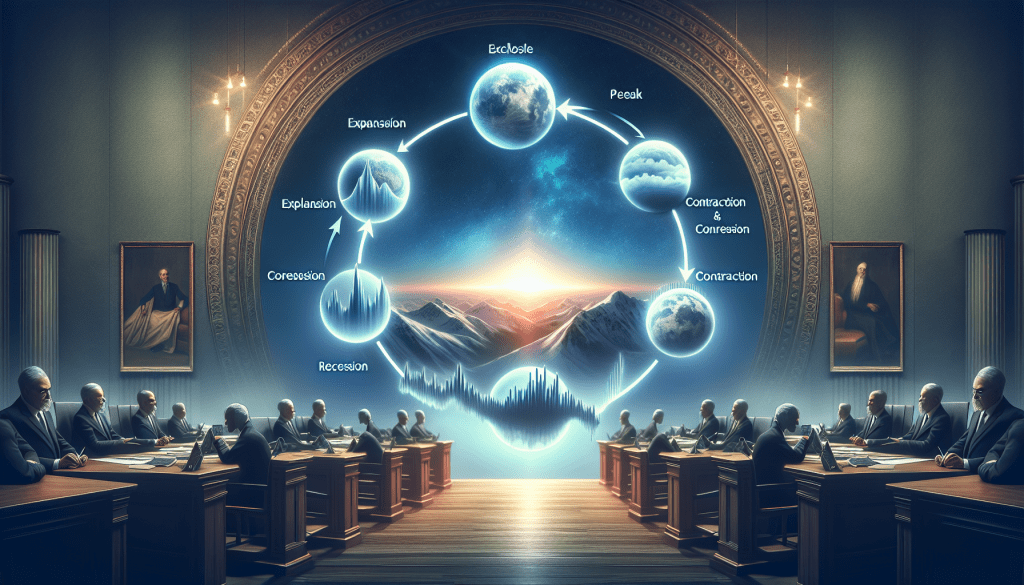

The Economic Cycle

The economic cycle, also known as the business cycle, has four stages: expansion, peak, contraction (recession), and trough.

- Expansion is a period of economic growth, rising employment, and high consumer confidence. The economy is expanding and most businesses are making money during an expansion. In order to combat inflation and keep the economy from overheating, governments may decide to raise tax rates. Interest rates may be raised by central banks in order to control inflation.

- The peak is the highest point of the economy before it begins to contract. The economy is producing its most at the cycle’s apex. Because of high employment and corporate profits, interest rates are typically at their maximum to combat inflation, and tax revenues are frequently strong.

- Contraction, or recession, is a period of economic decline and slowing growth. Central banks usually cut interest rates during recessions to encourage borrowing and investment. To stimulate the economy, governments might also lower taxes or raise public spending (fiscal stimulus). For instance, some countries implemented stimulus packages to boost the economy during the 2008 financial crisis.

- The trough is the lowest point of the economic decline, after which the economy starts expanding again. Interest rates are often low, and until the economy recovers, governments may keep up their fiscal stimulus programs.

Here it is worthy to notice that one of the most obvious sign that the economy heads a recession is Inverted Yield Curve. This is when the interest rates on short-term bonds are higher than the interest rates paid by long-term bonds. It’s one of the most reliable recession indicators.

Understanding Quantitative Easing

Quantitative easing (QE) is one instrument that central banks can employ during a recession. When traditional monetary policy has run its course, central banks turn to this one in order to boost the economy. In order to undertake quantitative easing (QE), a central bank purchases certain quantities of financial assets from commercial banks and other financial institutions. This raises the prices of the assets and lowers their yield while also expanding the money supply.

The U.S. Federal Reserve’s response to the 2008 financial crisis provides a real-world illustration of quantitative easing. In order to provide its member banks with cash so they might lend and invest it, the Fed purchased long-term assets from them in the hopes that this would spur economic growth. In the years that followed the crisis, the Fed purchased assets valued at over $4 trillion, making it one of the biggest quantitative easing initiatives in history.

We need to remember, however, that quantitative easing (QE) has the potential to cause asset bubbles and long-term inflation, among other negative effects. Nevertheless, QE can boost economic growth. Therefore, central banks must exercise caution when using this tool.

Leave a comment